The global market for rheumatoid arthritis treatments is expected to grow at a CAGR of...

Learn More

Our consulting solutions address company specific challenges with respect to micro environment...

Learn More

Organizations frequently need day-today research guidancein order to gain strategic...

Learn More

Exploring different areas of market research and market analysis is a key factor...

Learn MoreAcute Market Reports presents the most extensive global business research services across industries. Our research studies focus on potential outcomes, benefits, and risks associated with each market segment across geographies. Having served our global clients for more than 10 years, our prime priority is to enable our clients in making well-informed business decisions through a data-driven, analytical, and uncomplicated research approach.

We provide access to the world's most comprehensive, analytical, and updated business intelligence services and solutions.

The Small Outline Transistor (SOT) Package Market is a rapidly growing segment of the semiconductor packaging industry. The SOT package is a type of surface-mount package that is widely used for packaging small-sized discrete semiconductor devices, s...

Read More

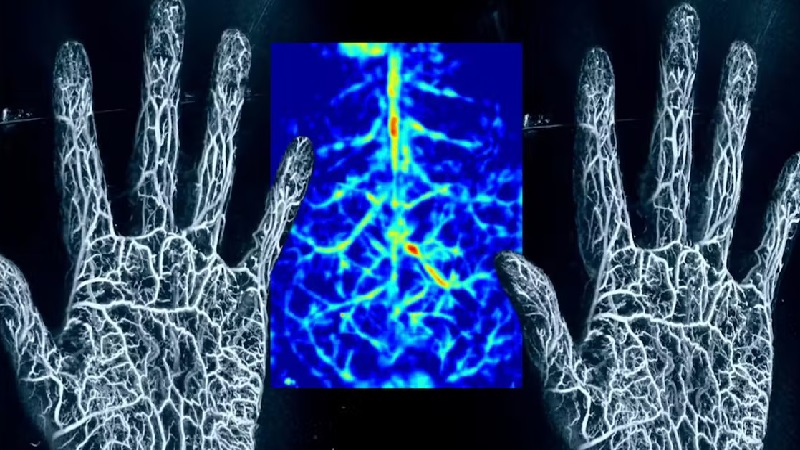

The photoacoustic imaging market is a rapidly growing segment in the field of medical imaging. The market is expected to register a CAGR of 16% during the forecast period of 2025 to 2033. Photoacoustic imaging combines the principles of laser-induced...

Read More

The graphite market, historically rooted in its diverse range of applications, has been a cornerstone for many industries. Renowned for its exceptional conductivity, lubrication properties, and heat resistance, graphite remains indispensable. In 2025, this market witnessed substantial momentum, c...

Read More