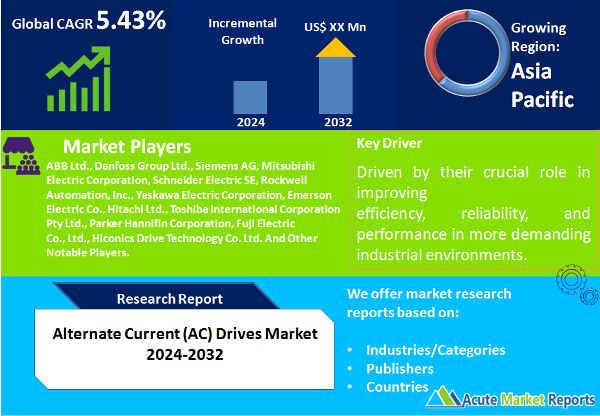

AC drives, also known as variable frequency drives (VFDs), are a type of motor controller that drive an electric motor by varying the frequency and voltage supplied to the electric motor. This adjustment of frequency allows for the control of the motor's speed and torque, thereby offering energy savings and improved control over motor operations. AC drives are widely used in industries for applications such as pump speed control, conveyor systems, and fan speed control, among others. The market is driven by a compound annual growth rate (CAGR) of 5.43%. This growth is indicative of the increasing recognition of AC drives as essential components for enhancing operational efficiency, reducing energy consumption, and supporting sustainable industrial practices. The projected growth can be attributed to several factors, including the rising emphasis on energy conservation, the industrial trend towards automation and digitalization, and the strategic shift in industries towards more sustainable manufacturing processes. Furthermore, the development of more advanced AC drives that offer better integration with modern industrial systems is expected to propel the market forward. The robust growth rate also reflects the expanding applications of AC drives in sectors with the highest share of demand, such as HVAC, manufacturing, and water & wastewater treatment, where the benefits of using AC drives for energy management and process control are particularly pronounced.

Market Segmentation By Voltage

The low voltage AC drives segment stands as the highest revenue generator in the AC drives market. The preference for low voltage AC drives is attributed to their cost-effectiveness, ease of integration, and suitability for a wide range of standard motor control applications. This segment's strong revenue performance is a testament to its foundational role in driving energy efficiency and operational optimization in both industrial and commercial settings. The medium voltage AC drives segment is distinguished by the highest compound annual growth rate (CAGR) within the AC drives market. This exceptional growth rate showcases the segment's rapid expansion and growing demand, particularly in industries that require higher power ratings and enhanced control for large motor applications. The increase in adoption of medium voltage AC drives is driven by their crucial role in improving efficiency, reliability, and performance in more demanding industrial environments.

Market Segmentation By Drive

The reversible AC drives segment represents the highest revenue earner within the AC drives market for the year 2025. This segment's dominance is largely attributed to the versatile functionality of reversible AC drives, which are essential in applications requiring the capability to reverse motor direction. This feature is crucial across a broad spectrum of industries, including manufacturing, material handling, and various automation systems, where the need for dynamic control over motor operations is paramount. The high demand for reversible AC drives underscores their importance in enhancing operational flexibility, energy efficiency, and overall process optimization, making them a preferred choice for businesses aiming to leverage advanced motor control technologies. This growth trend highlights the segment's expanding role and increasing demand within the market, especially in applications where motor direction remains constant. The preference for irreversible AC drives in certain operational settings, such as fixed-direction fans, pumps, and blowers, is driven by their ability to offer efficient and reliable control in straightforward applications. The notable CAGR points towards a growing market inclination towards these drives, driven by their contribution to operational efficiency and the strategic emphasis on energy conservation and cost-effectiveness in industrial practices.

Market Segmentation By Applications

In 2024, the pumps application segment leads in revenue within the AC drives market. This prominence is attributed to the critical role pumps play in a wide array of industries, including water treatment, oil and gas, and manufacturing. The necessity for efficient, reliable pump operation drives the demand for AC drives in this segment, as they significantly enhance energy savings, control, and operational efficiency. The extensive use of pumps across various sectors, coupled with the increasing emphasis on energy efficiency and sustainability, solidifies this segment's position as the top revenue generator. The need for precise control and optimization of pump operation, especially in critical applications such as water distribution and chemical processing, underscores the continued reliance on AC drive technology to meet these operational demands effectively. The compressor application segment exhibits the highest compound annual growth rate (CAGR), starting from a base year of 2025. This growth reflects the expanding application of compressors in sectors such as HVAC, refrigeration, and industrial manufacturing, where energy efficiency and operational reliability are paramount. The increasing demand for AC drives in the compressor segment is driven by the need to optimize compressor operation, reduce energy consumption, and enhance system reliability and lifespan. The significant CAGR underscores the growing recognition of the benefits that AC drive technology brings to compressor applications, including improved control over compressor speed, reduced wear and tear on equipment, and lower operational costs. This trend highlights the strategic shift towards more energy-efficient and sustainable practices in industries reliant on compressor systems, further driving the adoption of AC drive technology to meet these evolving operational requirements.

Market Segmentation By Geography

In 2024, the Asia Pacific (APAC) region emerges as the leader in revenue within the AC drives market. This region's dominant revenue position is attributed to its rapid industrialization, extensive manufacturing base, and the increasing adoption of energy-efficient technologies. The APAC market benefits from a robust demand across various sectors, including manufacturing, energy, and construction, driven by the ongoing urbanization and industrial growth in major economies such as China, India, and Japan. The emphasis on improving energy efficiency and reducing carbon emissions in these countries further amplifies the demand for AC drives, positioning the APAC region as the highest revenue generator. The region's commitment to adopting sustainable industrial practices and the continuous expansion of its industrial sectors underscore the significant revenue figures reported in 2024. Additionally, the Asia Pacific region not only leads in revenue but also showcases the highest compound annual growth rate (CAGR) in the AC drives market. This remarkable growth rate is a testament to the dynamic expansion of industries within the region that increasingly integrate AC drive technology for enhanced operational efficiency and energy savings. The high CAGR reflects the rapid pace of technological adoption, government initiatives supporting energy efficiency, and the burgeoning demand for automation and advanced manufacturing technologies across the region. The combination of a vast industrial base, increasing environmental awareness, and strategic investments in infrastructure development propels the APAC region to the forefront of market growth, highlighting its critical role in the global AC drives market expansion.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Alternate Current (AC) Drives market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Voltage

| |

Drive

| |

Applications

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report