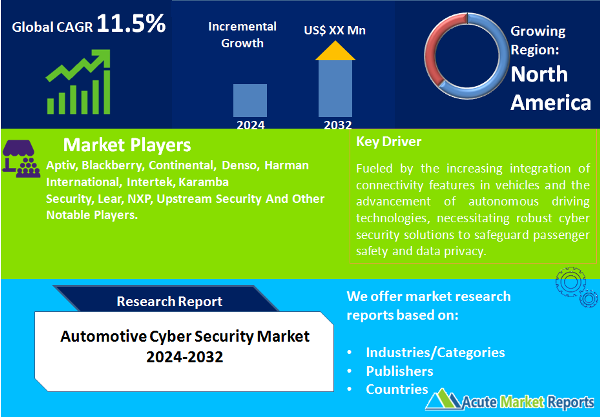

The automotive cyber security market is expected to grow at a CAGR of 11.5% during the forecast period of 2025 to 2033. Automotive cyber security market is crucial in the era of connected and autonomous vehicles, where digital advancements make vehicles more susceptible to cyber threats. This market encompasses technologies and services that protect vehicle systems and data from malicious attacks, unauthorized access, and other cyber threats. With the increasing integration of connectivity features in vehicles, such as Wi-Fi, Bluetooth, and cellular networks, along with the rise of autonomous driving technologies, the need for robust cyber security solutions has become imperative to ensure passenger safety and data privacy.

Driver 1: Increasing Connectivity in Vehicles

Expansion of Connected Car Features

The proliferation of connected car features is a significant driver for the automotive cyber security market. As vehicles become more integrated with wireless networks and cloud services to offer features such as real-time traffic alerts, remote diagnostics, and entertainment systems, they also become more vulnerable to cyberattacks. This vulnerability necessitates advanced cyber security solutions to protect against potential breaches that could compromise vehicle functionality and driver safety.

Regulatory Requirements for Vehicle Data Protection

Regulations and standards mandating enhanced security measures for connected vehicles also drive the market. Governments and international bodies are implementing stricter regulations to ensure that automakers incorporate robust cyber security protocols to protect consumers. For example, the U.N. Regulation No. 155 requires vehicles to have systems to manage cyber security risks and protect against cyberattacks, influencing automakers to prioritize and invest in cyber security solutions.

Consumer Demand for Secure Connected Features

Consumer awareness and demand for secure connectivity features in vehicles further propel the automotive cyber security market. As consumers become more knowledgeable about the potential risks associated with connected vehicles, they are increasingly prioritizing security features in their purchasing decisions. Automakers are responding by integrating advanced cyber security measures into their vehicles to attract security-conscious buyers and enhance brand loyalty.

Driver 2: Advancements in Autonomous Vehicle Technologies

Growth of Autonomous Driving

The advancement of autonomous vehicle technologies is another critical driver for the automotive cyber security market. Autonomous vehicles rely heavily on software to operate and make decisions, making them prime targets for cyberattacks. The need to protect these vehicles from potential threats that could lead to accidents or misuse is driving the demand for sophisticated cyber security solutions.

Integration of IoT in Automotive Systems

The integration of the Internet of Things (IoT) in automotive systems further accelerates the need for automotive cyber security. IoT devices in vehicles collect and transmit vast amounts of data, presenting new vulnerabilities. Protecting this data and ensuring secure communication between IoT devices and vehicle networks is essential, boosting the cyber security market.

Partnerships Between Automakers and Tech Companies

Partnerships between automakers and technology companies to develop secure autonomous driving systems also support the growth of the automotive cyber security market. These collaborations help combine expertise in vehicle manufacturing and cyber security, leading to the development of innovative solutions that ensure the safety and security of autonomous vehicles.

Driver 3: Increasing Cyber Threats and Attacks on Vehicles

Rise in Vehicle Cyberattacks

The increasing frequency of cyberattacks targeting vehicles directly drives the need for enhanced automotive cyber security solutions. As cybercriminals become more sophisticated, the tactics used to exploit vulnerabilities in vehicle systems are evolving, necessitating more advanced security measures to protect against these threats.

Complexity of Vehicle Electronic Systems

The growing complexity of vehicle electronic systems makes them more susceptible to cyber threats. Modern vehicles contain numerous electronic control units (ECUs) that manage everything from engine timing to infotainment systems. Each of these systems presents potential entry points for hackers, emphasizing the need for comprehensive cyber security solutions across all vehicle systems.

Need for Standardization Across the Industry

The lack of standardization in automotive cyber security practices across the industry makes it challenging to ensure consistent security measures, increasing the risk of cyber threats. This issue highlights the necessity for industry-wide standards and practices that can provide a unified approach to securing vehicles against cyberattacks.

Restraint: High Cost of Cybersecurity Solutions

Financial Implications for Manufacturers and Consumers

A major restraint in the automotive cyber security market is the high cost associated with developing and implementing cyber security solutions. These costs are often passed on to consumers, making vehicles more expensive and potentially limiting market growth. The development of effective cyber security measures involves substantial investment in research and development, software updates, and system maintenance to keep pace with continuously evolving cyber threats. While necessary, these expenses can deter automakers from fully investing in cyber security solutions and can make these advanced secure vehicles less accessible to price-sensitive consumers.

Market Segmentation by Security

The automotive cyber security market is segmented into application, network, and endpoint security, each addressing specific vulnerabilities within vehicle systems. Network security is projected to witness the highest Compound Annual Growth Rate (CAGR) due to the increasing complexity and connectivity of vehicle networks that require robust protection against external threats. This growth is fueled by the escalating need to secure communication channels between internal vehicle networks and external networks, including V2X (vehicle-to-everything) communications which are becoming more prevalent as the technology matures. Meanwhile, application security holds the largest share in terms of revenue. This segment benefits from the critical need to protect software applications that run on various vehicle systems from malicious attacks and unauthorized access. As vehicles become more software-driven, particularly with the rise of autonomous driving technologies, the importance of securing these applications becomes paramount to prevent attacks that could compromise vehicle safety and functionality. Endpoint security also plays a crucial role, focusing on protecting entry points of end-user devices such as vehicle infotainment systems and connected mobile devices. However, its growth and revenue are slightly less pronounced compared to network and application security, given the broader and more critical impacts of network breaches and application vulnerabilities in the automotive context.

Market Segmentation by Form

In terms of form, the automotive cyber security market is segmented into in-vehicle cyber security and external cloud cyber security. In-vehicle cyber security is expected to dominate both in terms of the highest CAGR and revenue generation. This segment's growth is driven by the increasing integration of advanced electronic components and connectivity features within vehicles, necessitating robust internal security measures to protect against cyber threats directly affecting vehicle operation and safety. The rising adoption of autonomous and connected vehicles, which rely heavily on in-vehicle electronic systems for their operation, further accelerates the demand for in-vehicle cyber security solutions. On the other hand, external cloud cyber security is also critical as it protects data transmitted between vehicles and external cloud services, including personal data and critical operational information. As the use of cloud-based services grows in automotive applications for enhanced data analytics, fleet management, and software updates, so does the need for strong cyber security measures to protect these cloud environments. However, the immediate and direct impacts of breaches in in-vehicle systems on driver safety result in a larger focus and higher revenue for in-vehicle cyber security compared to external cloud cyber security.

Geographic Segment and Competitive Trends

The automotive cyber security market is witnessing dynamic geographic trends, with North America currently leading in terms of revenue, driven by the presence of major automotive and technology companies, coupled with stringent regulatory standards regarding vehicle cyber security. However, Asia Pacific is expected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period from 2025 to 2033. This anticipated growth is fueled by rapid advancements in automotive technologies, increasing adoption of connected cars, and rising awareness of cyber security needs in emerging economies such as China, Japan, and South Korea. The region's focus on becoming a hub for automotive innovation, combined with growing investments in automotive manufacturing and infrastructure, supports this accelerated growth rate.

Competitive Landscape and Key Strategies of Top Players

The competitive landscape in the automotive cyber security market includes key players such as Aptiv, Blackberry, Continental, Denso, Harman International, Intertek, Karamba Security, Lear, NXP, and Upstream Security. In 2024, these companies reported substantial revenues, underscoring their strong positions in the market. From 2025 to 2033, these players are expected to intensify their focus on innovation and expansion to maintain and enhance their market presence. Strategies will likely include advancements in technology to address emerging cyber security challenges, expansion into new geographic markets, and collaborations with automotive manufacturers to integrate cyber security solutions directly into new vehicles. Research and development will be pivotal, with an emphasis on creating more robust security solutions that can anticipate and mitigate evolving cyber threats. Partnerships and acquisitions are also anticipated to be key strategies for these companies as they seek to broaden their technological capabilities and access new customer segments. Furthermore, these firms are expected to leverage AI and machine learning technologies to enhance their cyber security offerings, providing more proactive and adaptive solutions to meet the increasing complexities of automotive cyber security. As the automotive industry continues to evolve towards autonomous and connected vehicles, these companies will play a crucial role in ensuring the safety and security of the automotive ecosystem.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Cyber Security market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Vehicle

| |

Security

| |

Form

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report