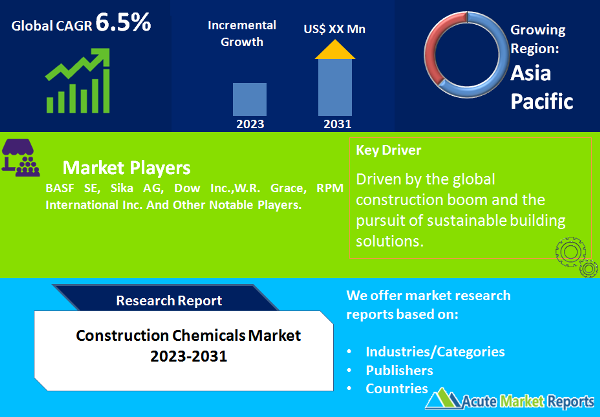

The construction chemicals market is expected to grow at a CAGR of 6.5% during the forecast period of 2025 to 2033. The construction chemicals market is a cornerstone of the construction industry, providing essential materials and solutions to enhance the performance and durability of various construction projects. The construction chemicals market serves as a vital enabler of modern construction practices, ensuring the longevity, sustainability, and aesthetic appeal of buildings and infrastructure. Key drivers such as infrastructure investments, sustainable construction practices, and urbanization continue to propel the market forward. However, regulatory compliance challenges pose a significant restraint, requiring manufacturers to navigate complex regulatory landscapes. Market segmentation by product and end-use caters to diverse construction needs, while geographic trends reflect the pace of urbanization and infrastructure development. Leading players are poised to maintain their competitive edge through innovation and strategic collaborations in the coming years. The construction chemicals market is on a steady path toward growth, driven by the global construction boom and the pursuit of sustainable building solutions.

Growing Infrastructure Investments

One of the primary drivers propelling the construction chemicals market is the increasing level of infrastructure investments globally. Governments and private sector entities are allocating substantial budgets to develop and upgrade infrastructure, including roads, bridges, airports, and residential buildings. In 2024, numerous countries launched ambitious infrastructure projects, stimulating robust demand for construction chemicals. These materials are integral in enhancing the longevity and performance of infrastructure, resulting in higher market revenues.

Sustainable Construction Practices

Sustainability has become a central focus in the construction industry. There is a growing awareness of the environmental impact of construction activities, leading to the adoption of sustainable building practices. Construction chemicals, such as eco-friendly adhesives and sealants, are vital components of green construction. In 2024, the demand for sustainable construction chemicals surged as more builders and developers embraced environmentally friendly solutions. This trend is expected to continue during the forecast period, driving both revenue and innovation in the market.

Urbanization and Real Estate Development

Urbanization continues to be a global megatrend, with an ever-increasing portion of the world's population residing in urban areas. This trend fuels the demand for residential and commercial properties, leading to substantial construction activities and the need for high-performance construction chemicals. In 2024, rapid urbanization drove significant construction activity in urban centers. The construction chemicals market benefited from this trend as developers sought advanced materials to ensure the durability and aesthetic appeal of their projects.

Regulatory Compliance Challenges

A significant restraint impacting the construction chemicals market is the complexity of regulatory compliance. Different regions and countries have varying standards and regulations related to construction materials, posing challenges for manufacturers to meet these requirements effectively. In 2024, some construction chemical manufacturers faced hurdles in ensuring that their products complied with the evolving regulatory landscape. This complexity delayed product launches and market expansions, impacting revenue growth.

Market Segmentation by Product: Concrete Admixtures Dominate the Market

The construction chemicals market encompasses a range of products, including concrete admixtures, concrete adhesives, concrete sealants, and protective coatings. In 2024, concrete admixtures dominated the market in terms of both revenue and growth potential due to their widespread use in construction projects. Concrete admixtures were in high demand in 2024 as builders sought to improve the workability, strength, and durability of concrete. These products played a pivotal role in shaping the market's revenue landscape.

Market Segmentation by End-use: Non-Residential Segment Dominates the Market

The market segmentation by end-use categorizes construction chemicals based on their application in residential and non-residential/infrastructure projects. In 2024, non-residential and infrastructure projects generated the highest revenue due to the extensive construction of commercial buildings and public infrastructure. Non-residential and infrastructure construction projects, such as office complexes, industrial facilities, and transportation infrastructure, were prominent contributors to the construction chemicals market in 2024. These projects relied on specialized construction chemicals to meet stringent performance requirements.

APAC Remains as the Global Leader

Geographic trends in the construction chemicals market are shaped by factors such as economic growth, population expansion, and urbanization rates. In 2024, regions with the highest urbanization rates, such as Asia-Pacific and the Middle East, represented leading markets for construction chemicals. Asia-Pacific, with its rapid urbanization and extensive infrastructure development initiatives, experienced substantial growth in the construction chemicals market in 2024. The Middle East, driven by large-scale construction projects, also played a pivotal role in market expansion. Looking ahead to the period from 2025 to 2033, the Asia-Pacific region is expected to maintain the highest Compound Annual Growth Rate (CAGR). The continuous urbanization of major cities and the expansion of transportation networks will drive the demand for construction chemicals in this region.

Market Competition to Intensify during the Forecast Period

The construction chemicals market is highly competitive, with several established players, including BASF SE, Sika AG, Dow Inc.,W.R. Grace and RPM International Inc. dominating the industry. In 2024, these top companies continued to innovate their product portfolios, expand their global presence, and engage in strategic collaborations to maintain their market leadership. Leading players in the construction chemicals market invested in research and development to introduce advanced and sustainable construction solutions. They also focused on forming partnerships with construction companies and architects to promote the adoption of their products. In the forecast period from 2025 to 2033, these top players are expected to remain at the forefront of the market, leveraging their expertise in developing cutting-edge construction chemicals. Moreover, the market may see the emergence of niche players specializing in eco-friendly and innovative construction solutions.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Construction Chemicals market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

End-Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report