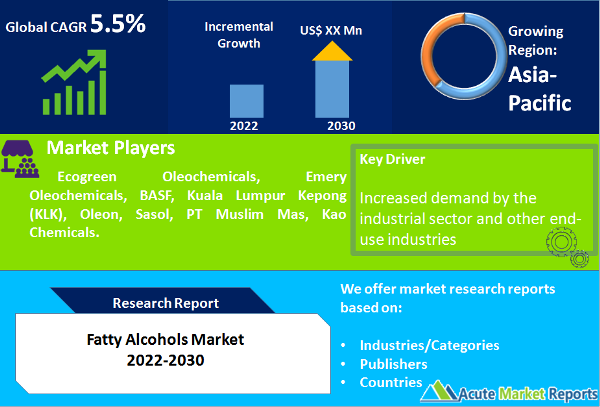

Fatty alcohol market is expected to cross the market revenues of US $10 billion by 2030 growing at a CAGR of 5.5% during the forecast period of 2023 to 2030. During the forecast period, the personal care industry is anticipated to be driven by a growth in global demand for hygiene products, as well as an increase in the level of consumer awareness. It is anticipated that the market for personal care products would be driven by a shift in customer preference toward bio-ingredient based product demand. This preference shift is a result of rising knowledge regarding the potential toxicity caused by petrochemical goods. These variables, in turn, are accountable for a favourable impact that has been exerted on the demand for fatty alcohols in the personal care business.In their natural state, fatty alcohols can be broken down into simpler substances and serve the same purpose as petrochemicals. In addition to this, using them rather of petrochemicals is a more economical option. It is anticipated that an increase in the supply of sustainable raw materials in the form of oilseed will have a good impact on the production of fatty alcohols. As a result of this, it is anticipated that vast horizons will be provided for downstream applications, which would ultimately lead to increased market penetration. Fatty alcohols can be found in a variety of oils, the most common of which being palm oil, soybean oil, sunflower oil, safflower oil, rapeseed oil, tall oil, and cattle tallow.

Spread of Covid-19 Had a Significant Impact on the Raw Material Prices

In the year 2020, the price of palm oil has substantially decreased all around the world as a direct result of the widespread COVID-19 outbreak. There has been a huge decrease in the production of palm oil as a direct result of the disruption in the global supply chain and the lockdown scenario that exists in several Asian countries. The amount of palm oil that Indonesia exported in February 2020 was 2.54 million tonnes, which is a decrease of 12% compared to the same month the previous year. The quantity of palm oil that was shipped out of Malaysia, which is the world's second-largest producer of palm oil, decreased to 8.90 million tonnes in comparison to the volume that was shipped out the year before. China and India together make up the majority of palm oil's global importers. The COVID-19 epidemic that broke out in China has led to a major decrease in the market for palm oil. In addition, the supply is severely curtailed as a result of import limitations that have been placed on refined palm oil in India. Therefore, the ever-changing costs of raw materials have a direct impact on the final prices of fatty alcohols, which acts as a significant barrier to the expansion of the industry.

Increasing Demand for Eco-Friendly Solution Boosting the Market for Fatty Alcohols

An increase in customers' awareness of environmental issues is pushing them to purchase products that are less harmful to the environment. These kinds of considerations are pushing chemical firms toward the utilisation of bio-based raw materials in the production of their goods. In comparison to alternatives based on petrochemicals, fatty alcohols derived from oleo-based feedstock are not only recyclable but also less hazardous to human health, making them the material of choice for the production of cosmetics and other personal care goods. As a result of this trend toward biodegradable and environmentally friendly cosmetic products, the demand for fatty alcohols is expected to continue to increase over the course of the forthcoming period.

It is anticipated that the many applications for fatty alcohols, including textile coatings, mineral processing, home and industrial cleansers, detergents, laundry softeners, and agricultural chemicals, will drive the demand for fatty alcohols to a significant extent. In addition, the growth of the cosmetics and personal care sector is anticipated to be a vital factor in underpinning the global market at a considerable rate during the period of the forecast.The market for organically derived ingredients to use in the production of cleaning products such as detergents and soaps as well as personal care products is what is driving the demand for naturally derived fatty alcohols. The expansion of environmental and health issues around the world in relation to the utilisation of fatty alcohols derived from petrochemicals is the primary driver of market growth. In addition, many different industries are moving in the same direction, which is the efficient development of biodegradable and naturally derived chemicals and products through the utilisation of bio-based raw materials. This is being done in an effort to reduce the carbon footprint that humans leave on the planet.

Rising Demand for Surfactants Driving theMarket Growth.

It is well acknowledged that the rising demand for surfactants in personal care products such as conditioners, lipsticks, shower gel, and antiperspirant is a crucial factor that has the potential to greatly expand the market over the course of the forthcoming time. It is anticipated that the cost-effectiveness and inherent biodegradability of these products would drive growth in the natural fatty alcohol market over the course of the year under study.

Volatility of Raw Material Prices Impacting the Market Adversely

The fluctuating prices of raw material, which is essential for the production of Fatty Alcohol, are the primary factor that is restraining the market. This is because the production of fatty alcohol is impacted, and as a result, so is the price of fatty alcohol in accordance with the various requirements of the various market segments. Palm oil, rapeseed oil, and PK oil are the three types of oils that are utilised in the manufacturing of fatty alcohol. Due to the climatic conditions in Asia being more conducive to the production of fatty alcohol, Europe and North America import these raw materials from Asia. The current state of trade between these regions will determine how much these primary commodities will cost. During the time period covered by the projection, the market could be negatively affected by the fluctuating prices.This impacts not only the distribution of the fatty alcohol to the required organisation but also the supply chain. Consequently, affecting the overall market such as the market for personal care products, the market for detergents, etc. As a result, the market is being constrained by the fluctuating pricing of raw materials.

Increased Cost of Production Remains High Making the Market Less Lucrative for Earning Margins

It is anticipated that the high costs that are involved with the manufacturing process will be a significant element that can function as a barrier to the expansion of the industry during the term under consideration. Demand for natural fatty alcohols is expected to increase during the forecast period due to a number of factors, including volatile prices and stringent regulations imposed by a number of government agencies in response to the negative impact that fatty alcohols derived from petrochemicals have had on the environment. On the other hand, the volatile pricing of raw materials and stringent regulations imposed by the government are expected to impede the expansion of the market. On the other hand, a surge in demand from developing countries such as Asia-Pacific and LAMEA is anticipated to create lucrative prospects for the market participants in the market.

Increasing Uptake of Liquid Detergent over Powder Detergents Opens an Avenue of Opportunity

The rise in per capita income in emerging economies has resulted in an enhanced standard of living, which in turn has led to a shift in the behaviour of consumers and improvements in their standard of living. The modern consumer is on the lookout for high-quality goods that make their work simpler, much in the same way as liquid detergents make the routine tasks of cleaning and maintaining sanitation in the home more straightforward. Liquid detergents make it easier to use detergents in washing machines, which are becoming increasingly prevalent in homes; as a result, liquid detergents are also becoming increasingly common in dishwashers, which are themselves becoming increasingly widespread. This, in turn, will propel growth in the market for fatty alcohol.

C11-C14 Fatty Alcohols Leading the Market in terms of Revenues

In 2021, C11-C14 fatty alcohols emerged as the most dominant product segment, in terms of revenues, accounting for more than 58 percent of the total market.Over the course of the forecast period, this product category is anticipated to be driven by an increase in demand for C11-C14 alcohol, particularly in Asia Pacific. In the production of sodium laureth ether sulphate, also known as SLES, which is a significant foaming agent used in the composition of shampoo and body wash, C11-C14 fatty alcohols are employed. During the forecast period of 2023 to 2030, C15-C22 fatty alcohols are predicted to be the product segment with the highest CAGR registering the fastest growth rate due to increasing application areas such as in lubricant bases and blends as well as personal care products such as moisturisers.

Detergents and Cleaners Dominating the Market Revenues, Whereas Cosmetics and Personal Care Products to Dominate the Market Growth

The global market for fatty alcohol based on application is segmented as cosmetics and personal care, detergents and cleaners, lubricants, pharmaceuticals, plasticizers, food and nutrition, and others. The overall market for detergents and cleaners held the largest share in 2021 by contributing about 33% of the global revenues. Nevertheless, it is anticipated that the segment of cosmetics and personal care products will experience the highest CAGR of 7.5%during the forecast period of 2023 to 2030. It is anticipated that the rapid growth of the cosmetics and personal care business, along with an increase in the amount of money spent on skincare products, particularly by males, will boost the demand for fatty alcohols over the duration of the projection.The market for cosmetics and personal care products is expected to show the greatest growth over the course of the forecast period, particularly in the Asia-Pacific region. This is due to the fact that individuals in the emerging economies are witnessing an increase in their disposable income, and the fact that India has a huge pool ofyoungestpopulation in the world.

Asia Remains as the Global Leader

The Asia-Pacific region emerged as the largest market for the fatty alcohol market in 2021, with a market share of approximately 38% in 2021 and it is anticipated that it would maintain its preeminent position during the period of forecasting. This is the case as a result of a growth in per capita income in growing economies such as India, China, and other Asia countries. This has caused a change in their lifestyle, and as a result, people are looking for quality products that are also easy to use. As a result, there has been a rise in the production of high-end cosmetic items and detergents of the highest quality. The requirement for the product to be simple to use, such as the application of liquid detergents in washing machines, has contributed to a growth in the usage of liquid detergents and, as a result, an increase in the market for fatty alcohol. This creates a fantastic environment for the market for cosmetic products, which in turn drives the market for fatty alcohol. India has the highest percentage of its population that is under the age of 25.Additionally, Asian nations such as Indonesia, China, and Malaysia are the leading producers of fat and oil on a global scale. This fact, in conjunction with the existence of a manufacturing hub of Fatty Alcohol and its derived products in the region, is positively influencing the market for Fatty Alcohol through the year 2030.Due to the high demand for bio-based fatty alcohols, which are utilised in the production of cosmetics and personal care products, the market for Fatty Alcohol in Europe ranked second in terms of revenue for the year 2021. On the back of inflated commodity costs on the regional market in 2023, prices of fatty alcohol in Europe experienced a sharp increase during the second quarter of that year. On the regional market, the price of palm oil skyrocketed as a result of the feeding frenzy caused by the quantity of feed coming from Indonesia and Malaysia. The European market saw a corresponding increase in the cost of producing fatty alcohol as a result of the recent spike in the price of palm oil. Due to a disparity that developed in the market between supply and demand, there was a subsequent increase in the price of fatty alcohol on the market. As the temperature soared across Europe, prices associated with energy continued to be among the highest in the country. In addition, demand from the personal care and surfactant industries continued to be strong, which resulted in a significant increase on demand for fatty alcohol in the local market.North America grew at a significant rate in the historical years and is anticipated to grow at a promising rate during the forecast period. The current stringent restrictions limiting the application of chemicals in detergents are anticipated to result in an increased demand for natural fatty alcohols, which is predicted to strengthen the regional commerce. Because of these regulations, the regional trade is expected to be strengthened. Due to the rise of end-use industries such as cosmetics and personal care as well as surfactants, it is anticipated that the market in the Middle East and Africa would have a CAGR of 7%during the forecast period.

Increased Market Fragmentation to Intensify Competition

The global market is extremely fragmented as a result of the presence of a large number of small and medium-sized enterprises that are particularly active in Asia-Pacific and Central and South American countries. Companies such as Ecogreen Oleochemicals and Emery Oleochemicals, as well as BASF, Kuala Lumpur Kepong (KLK), Oleon, Sasol, PT Muslim Mas, and Kao Chemicals, are among the most prominent players in the global market.It is predicted that the ongoing development of the product, along with an increasing number of activities to expand production capacity, would strengthen the competitiveness of the industry during the forecast period.The increased availability of raw materials in China, Malaysia, and Indonesia, such as soy, rapeseed, and corn, has driven a number of chemical manufacturers to relocate their bases from Europe and North America to Asia Pacific in order to capitalise on investment opportunities there.Large Asian plantation firms are investing in downstream feedstock capacities to overcome decreased profitability and to restrict capacity overhang of fatty alcohols. These goals are being pursued simultaneously. These corporations have formed partnerships with chemical producers over the past few years in order to consolidate Asia Pacific's position as the world's largest hub for the production of base fatty alcohols and downstream goods.The report reveals primary, secondary and tertiary strategies followed by tier 1, tier 2 and tier 3 market players.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Fatty Alcohols market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Application

| |

Source

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report