In the field of electrical engineering, an electric switchgear is defined as a combination of devices which include switches, fuses, isolators, circuit breakers, relays, control panels, lightning arrestors, current transformers and potential transformers, among others. The switchgear is typically used to detect faults and disconnects the corrupted section from the circuit to prevent any possible damage to the system. The switchgear equipment is essentially concerned with switching and interrupting currents either under normal or abnormal operating conditions. The use of switchgears, instead of fuse, offers superior benefits such as reliability, certain detection of faulty circuits, quick operation and provision of manual control. Owing to the aforementioned merits switchgears have been extensively used to protect electrical equipment for a variety of electrical end-users.

Switchgear protection plays a vital role in every step of modern day electrical system such as generation, transmission, and distribution. It prevents the loss of expensive electrical equipment from a variety of electrical abnormalities including over current, short circuit and any other faults in the system. Switchgears are available in a wide range, rating, and variety depending on the applications. Apart from power system networks, switchgears are also extensively used for industrial works, industrial projects, domestic and commercial buildings, marine applications and mining, among others. With growing trend of electrical network up-gradation, growing infrastructure for non-conventional energy systems and establishment of smart electric grids, switchgears provide a very crucial aid in the field of electrical system automation. Consequently, the demand for switchgears is expected to grow consistently with the smart grid applications across the globe.

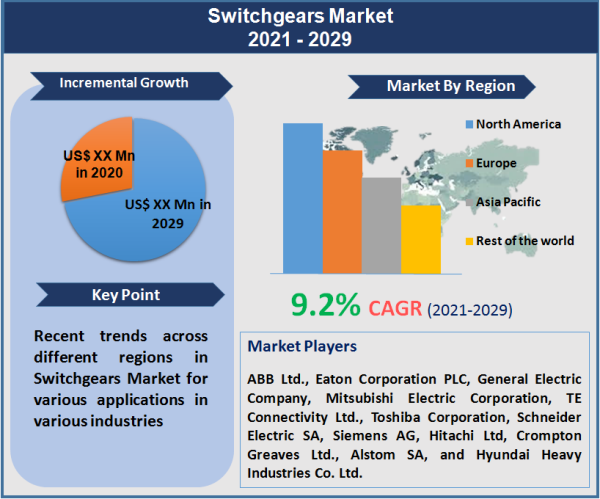

The report titled “Switchgear Market- Growth, Future Prospects and Competitive Landscape, 2021-2029” offers strategic insights into the global switchgears market with a focus on the market size and estimates for the duration 2019 to 2029. The said research study covers in-depth analysis of market segments based on voltage, end-use industry and cross-sectional study across different geographies. The study covers the comparative analysis of each sub-segment for the years 2020-2029. The report also provides a prolific view on market dynamics such as market drivers, restraints, and opportunities.

In order to help strategic decision makers, the report also includes competitive profiling of the leading switchgear manufacturers, their strategies, market positioning and key developments. Some of the major players profiled in the report include ABB Ltd., Eaton Corporation PLC, General Electric Company, Mitsubishi Electric Corporation, TE Connectivity Ltd., Toshiba Corporation, Schneider Electric SA, Siemens AG, Hitachi Ltd, Crompton Greaves Ltd., Alstom SA, and Hyundai Heavy Industries Co. Ltd.

Other in-depth analysis provided in the report includes:

Overall, the research study provides a holistic view of the global switchgear market, offering market size and estimates for the period from 2021 to 2029, keeping in mind the above-mentioned factors.

As of 2020, the low voltage switchgear (less than 1KV) segment dominated the overall switchgear market worldwide. Low voltage switchgears are used in a wide array of end-use applications such as commercial, residential, and industrial applications. With consistently growing industrial, commercial and residential infrastructures, the demand for switchgears is also growing in order to protect electric equipment from abnormalities of electric supply.

High voltage switchgear (above 75KV) segment trailed the low voltage segment in terms of revenue, as of 2020. High voltage switchgears are typically used in heavy applications such as power generation units, transmission and distribution utilities. With growing demand for power, the demand for aforementioned infrastructure is also growing persistently. Therefore, the demand for high voltage switchgears for the electricity generation and distribution is also expected to grow consistently throughout the forecast period from 2021 to 2029.

As of 2020, the transmission and distribution utility segment dominated the overall switchgears market worldwide. Consistently rising demand for power has encouraged the setup of new power plants, transmission and distribution utilities. Switchgears are extensively used to safeguard equipment and control systems from abnormalities of electricity systems in power plants, transmission and distribution utilities. Furthermore, the switchgears market is expected to grow in proportion with the growing trend of up-gradation and renovation of power transmission and distribution utilities and the introduction of smart grids.

The manufacturing and process industries end-use segment trailed the transmission and distribution utility segment in terms of revenue in the overall switchgears market, as of 2020. Post economic depression in the past, manufacturing and process industries have shown significant growth in the recent years. Switchgears are widely used in manufacturing and processing industries in order to protect electrical devices and circuits from overload, short-circuit and voltage fluctuations, among others. With consistent growth in the manufacturing and processing industries, the switchgears market is expected to witness positive growth in this segment.

As of 2020, Asia Pacific dominated the overall switchgears market in terms of revenue as well as in volume. Asia Pacific has been witnessing strong up-gradation in the electrical infrastructures and networking since past few years. With growing demand of electrical energy, new power plants, transmission, and distribution units are being set-up at a brisk pace. In order to provide protection to the expensive equipment in the aforementioned utilities, the demand for switchgears has increased significantly in the region. Furthermore, flourishing manufacturing and processing industries have also uplifted the demand for switchgears in this region. Owing to the aforementioned reasons, Asia Pacific is expected to dominate the overall switchgears market throughout the forecast period during 2021- to 2029.

North America trailed Asia Pacific in the overall switchgears market in terms of revenue and volume. Consistent development of smart grid infrastructures has escalated the demand for the switchgears in North America. Switchgears play a vital role in the development of non-conventional energy generation system by ensuring the safety of other equipment from overloads and voltage fluctuations. In addition, extensive use of switchgears in industrial manufacturing and processing units, commercial and residential infrastructures has also encouraged the growth of switchgears market.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Switchgears market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Voltage

| |

End-use

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report