Report Scope

This report analyzes the global transportation management systems (TMS) market in terms of deployment, end-use application, and geography. Based on deployment method, the global transportation management systems market is segregated into on-premise and on-demand or cloud-based. Similarly, on the basis of end-use application, the market for transportation management systems is further classified into food and beverage, retail, electronics/high-tech, automotive, manufacturing, transportation and logistics, others (pharmaceuticals, chemicals, etc.). The geographical distribution of the global transportation management systems market considered in this study encompasses regional markets such as North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Overview

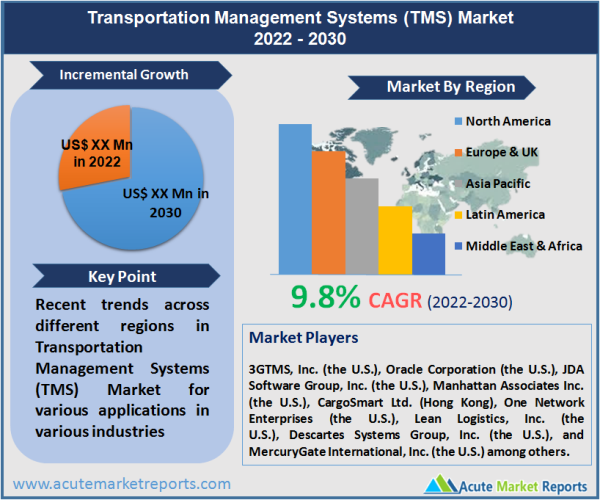

Growing popularity of SaaS-based solutions offering superior benefits in terms of cost, visibility, and maintenance is identified as the major factor driving market growth. The emergence of these cloud-based solutions is also expected to trigger the replacement of aging conventional TMS solutions. In addition, the growing preference for multi-channel distribution and demand for greater visibility in supply chain among shippers is expected to have positive impact on the market growth. These factors are expected to contribute towards 9.8% CAGR during the forecast period 2025 – 2033.

Traditionally, the deployment of transportation management systems was limited to industry verticals including food and beverage, retail, consumer goods, and hi-technology industries since these verticals had more opportunities to earn savings in different fields. However, the recent trend shows that wide range of manufacturers and distributors in other industry verticals are now convinced regarding the benefits offered and returns achieved using transportation management system solutions.

The transportation and logistics segment was the largest revenue contributing end-use application segment in the global transportation management system market in the base year of 2021. The segment accounted for around 60 percent of the global transportation management system market revenue in the same year. The limited workforce of truck drivers remains a major concern for transportation and logistics service providers and their shippers. The use of transportation management system solutions allows shippers to get a clearer scenario regarding the availability of driver and carrier capacity. Thus, transportation and logistics segment is poised to witness steady growth over the forecast period 2025 – 2033. On the other hand, with the proliferation of e-commerce and growing preference for omni-channel distribution, the demand for transportation management system solutions in retail is expected to exhibit robust growth over the forecast period.

In the base year of 2021, on-premise transportation management system solutions outnumbered on-demand transportation management system solutions. Although many transportation firms are favoring cloud-based prototypes, the bigger and established players are still heavily reliant on the on-premise software installations. Thus, on-premise solutions are expected to exhibit reasonable growth over the forecast period between 2021 and 2029. Transportation management solutions were one of the first supply chain management solutions to adopt the cloud-based model. Low upfront costs and easy maintenance coupled with the low entry barriers have enabled cloud-based applications to grow significantly across different supply chain management platforms. In addition, benefits offered in terms of visibility across the supply chain are fueling the demand for on-demand transportation management system solutions. In view of these benefits, shippers across the globe are less interested in implementing software solution and are more skewed towards changing their operation models to house a more sophisticated and comprehensive transportation network scenario.

In the base year of 2021, North America (comprising U.S. and Canada) was the largest transportation management systems market worldwide. The region accounted for over one third of the global market revenue in the same year. The U.S. represents the largest individual transportation management systems market worldwide. With the growing trend towards near-shoring and reshoring, the manufacturers are now relocating their manufacturing facilities back to the U.S. This has resulted in an increase in volumes of freight and related inflation in the region. To address these challenges and optimally manage freight, manufacturers are increasingly deploying TMS solutions that offer better supply chain visibility offering. Furthermore, with the prevailing trend towards omni-channel distribution, especially in e-commerce has been instrumental in pushing shippers to streamline their transportation components, which, in turn is stimulating the demand for transportation management systems.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Transportation Management Systems (TMS) market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Billion |

| Segmentation | |

Deployment Model

| |

End-use Application

| |

|

Region Segment (2023-2033; US$ Billion)

|

Key questions answered in this report